Approximately 40 million people worldwide — 18 million of which are from the U.S. — are considered digital nomads. Another 8 to 10 million U.S. citizens are considered expats.

Somewhere in that bunch, someone’s going to get the flu. Or twist an ankle. Or need to have a cavity filled. So what do expats and digital nomads do when they’re outside the United States and need medical care?

If you’re asking yourself this question as you prepare for your next international adventure, congratulations on thinking like a savvy global citizen.

This guide breaks down the types of insurance that might be available to you and why having a policy that’s designed specifically for someone like you, who’s out of the country for more than a year, is so important to your health and finances.

What Do Expats Do for Health Insurance?

When you no longer live in the United States, relying on the health insurance you had at home isn’t the best option. Those plans often have exclusions regarding care sought outside the U.S. Plus, you might not even be eligible for that plan anymore if you establish residence internationally.

What most expats and long-term digital nomads do for health insurance, then, is to seek coverage from a provider specializing in these kinds of plans.

The benefits are uniquely designed to meet the needs of someone who needs both routine, preventive care while they’re “away from home” as well as coverage that’s more common to travelers, such as emergency care and medical evacuations.

How Does Health Insurance Work for Digital Nomads & Expats?

The traditional health insurance you might get in the U.S. from an employer or through the marketplace often isn’t available to people living internationally. You might not be eligible if you no longer live on U.S. soil, or you might not even have an employer to provide that coverage (we see you, freelancers).

In instances such as these, private health insurance for expats and digital nomads is the best solution for taking care of your medical needs abroad.

1. U.S. health insurance typically doesn’t follow you overseas.

If you expect the health insurance you use in the United States to cover you overseas, double- and triple-check that policy for its coverage area and exclusions. Most U.S. health insurance does not provide coverage for care received abroad.

This means that, without other insurance, any treatment you receive would have to be paid for out of your own pocket. Depending on the situation, it could be incredibly expensive or even so costly that you wouldn’t be able to afford the care you need at all.

Rather than leaving it to luck or the kindness of strangers on GoFundMe, it’s best to have a plan that you know includes international medical coverage.

2. Most countries require proof of insurance for a digital nomad visa.

One of the few exciting things to come out of the COVID pandemic was an increased number of countries who offer digital nomad visas. While these provide greater working flexibility and opportunity, they don’t come without a bit of bureaucratic red tape.

Countries that offer a digital nomad visa also require proof of health insurance in order to get that visa. When applying, be sure to check the required coverage amounts and choose the tier of Expat & Nomad Insurance that meets those requirements (we offer five levels).

If you’re living or retiring in another country as an expat, your new home country might also require proof of health insurance, regardless of the type of visa you have.

It’s important to realize that even if your host country has universal healthcare, you might not be eligible for that until you are a full-time, legal resident of that country. Some, like Costa Rica, allow you to pay into their national healthcare system, but that’s the exception rather than the rule.

Before moving, research thoroughly the rules for healthcare for foreign visitors, even if you plan to own property and live there. You don’t want to find out in the middle of an emergency that you don’t have the coverage you need.

3. Get long-term coverage, with no limits on trip number or length.

Traditional travel medical plans have term limits. In other words, those plans will only cover trips up to a certain number of days, or they might only cover a certain number of trips during the course of the year.

Expat and Nomad Insurance, however, provides coverage for when you’re outside the U.S. for a year or more. This makes it ideal for when you’ve decided to live in another country rather than just visit, or if you plan to travel the world, working from a new location every few months.

4. You need coverage for everyday and emergency care.

When you’re living abroad, you want medical coverage that pays for a range of treatments, including routine, preventive care and dental care.

Travel medical insurance typically only covers treatment for emergency medical treatment. With health insurance for expats and nomads, however, you get both, meaning you can stay on top of your wellness, no matter where you live.

5. Expat and nomad insurance can cover dependents.

Estimates say that more than 30% of digital nomads travel with a partner full-time, and 26% travel with children aged 18 and younger. Those numbers are probably even higher among those starting a new home in another country as an expat.

If you’re traveling with family — a partner, kids, or both — Expat & Nomad Insurance will cover their health insurance needs, too. Dependent children can be covered up to age 20.

How is Expat & Nomad Insurance Different from Travel Medical Insurance?

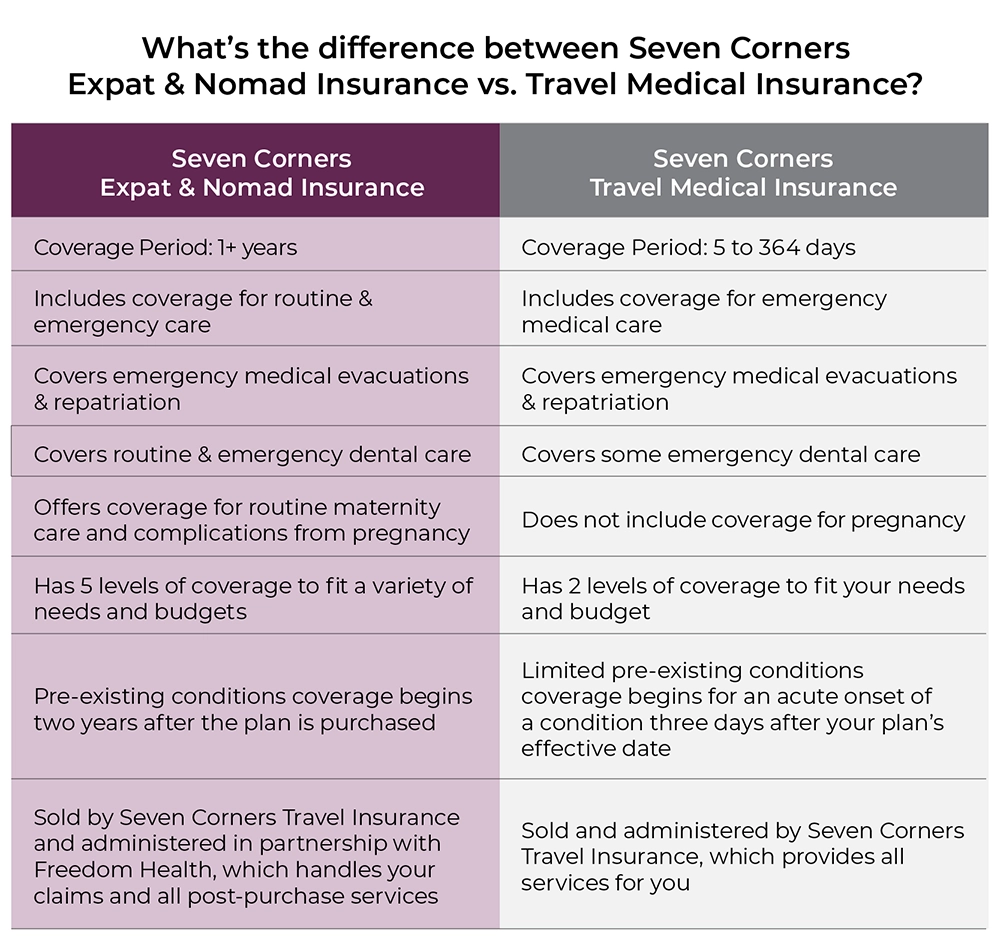

There are a few differences between Seven Corners Expat & Nomad Insurance and Seven Corners Travel Medical Insurance. While the chart below has a more complete list of those differences, here are a few highlights to help you compare:

- Expat & Nomad Insurance is designed for people planning to be out of the U.S. for more than a year. Travel Medical Insurance coverage can only be extended for a maximum of 364 days.

- Expat & Nomad Insurance is considered health insurance. It has more robust medical coverage than our travel insurance plans. Travel Medical Insurance, while designed to provide high levels of medical coverage, also includes benefits such as trip cancellation, trip delay, and baggage protection.

- Both plans offer emergency medical evacuation and repatriation in case you’re somewhere that can’t provide adequate care. Expat & Nomad Insurance, in addition to covering treatment for medical emergencies, also includes coverage for routine care like annual checkups and vaccines. That kind of coverage is not included in Travel Medical Insurance.

- Expat & Nomad Insurance includes coverage for pre-existing conditions, but only after the plan has been in effect for two years. Seven Corners Travel Medical Insurance includes limited coverage for pre-existing conditions if you have an acute onset of the condition. The amount of coverage varies by age, and there is a waiting period of three days before it applies.

For a complete list of benefits, benefit amounts, and exclusions, please view your plan documents.

Expat & Nomad Insurance does not include coverage for medical expenses incurred in the U.S. Contact us about getting a Seven Corners Travel Medical plan to protect your health if you return to the United States to visit.

How to Get Expat & Nomad Insurance

Seven Corners Expat & Nomad Insurance isn’t a travel medical plan. Instead, it’s private long-term health insurance. Learn more about this opportunity to protect your health while living and working abroad before you leave home.

It’s also a great idea to talk to a licensed agent to find out if Expat & Nomad Insurance is right for you, get a quote, and buy the coverage that can help you take this next exciting step toward your life abroad.